January Map of the Month

By William D. Bryan, Ph.D.

Tax season is fast approaching, and if you have invested in energy efficiency upgrades to your home over the past year you may be eligible for a federal tax credit that can offset some of your costs. The Energy Efficiency Home Improvement Credit, sometimes called the 25(c) credit, provides an annual tax credit of up to $3,200 for qualifying households that have invested in energy efficiency improvements since 2023. This includes up to $1,200 for efficient doors, windows, skylights, insulation, air sealing as well as for home energy audits. It also includes up to $2,000 per year for certain heat pumps, water heaters, or for stoves and/or boilers powered by biomass. Using data from the Internal Revenue Service (IRS), this Map of the Month explores the impact of these tax credits.

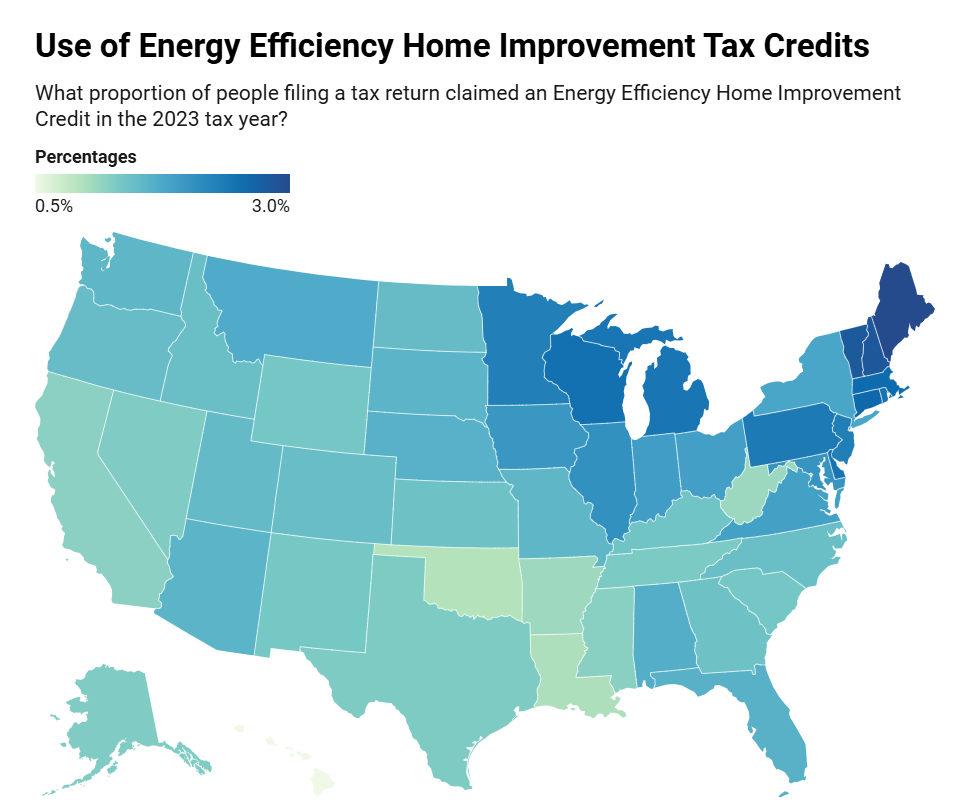

Since it was expanded in 2023 with the passage of the Inflation Reduction Act, the 25(c) credit has been used by millions of households across the United States. In the South, more than 500,000 residential households claimed this tax credit in 2023, putting almost half a billion dollars back into their pockets – around $904 per household, on average – to offset the costs of making their homes more efficient, more affordable, and safer. Virginia, Florida, and North Carolina had the highest proportion of filers who took advantage of the 25(c) credit, with more than 150,000 households in Florida alone using it to offset home improvement costs.

Nationally, the most popular uses of the 25(c) credit were to support the costs of air sealing and upgrading insulation, followed by replacing exterior windows and skylights, upgrading central air conditioners, and replacing exterior doors. More than 250,000 households across the nation used this credit to offset the costs of installing an electric or natural gas heat pump water heater, with 100,000 claiming the credit for installing highly efficient heat pump water heaters.

Although people of all incomes have benefitted from these tax credits, they tend to be used most by households with higher incomes. The majority of claims nationally (38%) were made by filers who made between $100,000 and $200,000 in 2023. Households making under $100,000 made up less than half of the total filers claiming a 25(c) credit (42%).

The 25(c) tax credit is a critical source of support to help households offset the costs of upgrading the quality of their homes, improving the long-term affordability of their housing. But Southern households lag the rest of the nation in claiming this credit and are leaving money on the table. In 2023, just 1.5% of households in the South reaped the benefits of 25(c), compared to 2.5% nationally. Louisiana, Arkansas, and West Virginia had some of the lowest rates of participation in the entire nation.

Housing costs are at historic highs, and millions of households in the South could benefit from home renovations that improve comfort and affordability. The 25(c) credit provides a key mechanism to support these upgrades in the region’s existing housing as well as spurring business for the tradespeople that provide home renovation services. So, be sure to file for a 25(c) tax credit if you have qualifying upgrades that improve your home’s comfort and value, if you want to keep more money in your pocket.