Month: November 2023

Map of the Month – November

Grace Parker

hover over the map to click through the slideshow

Source: Dynamic National Loan-Level Dataset, U.S. Consumer Financial Protection Bureau; Maps: SEEA

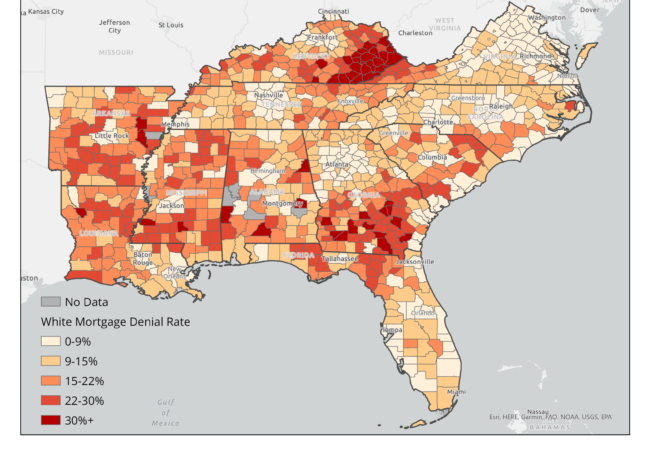

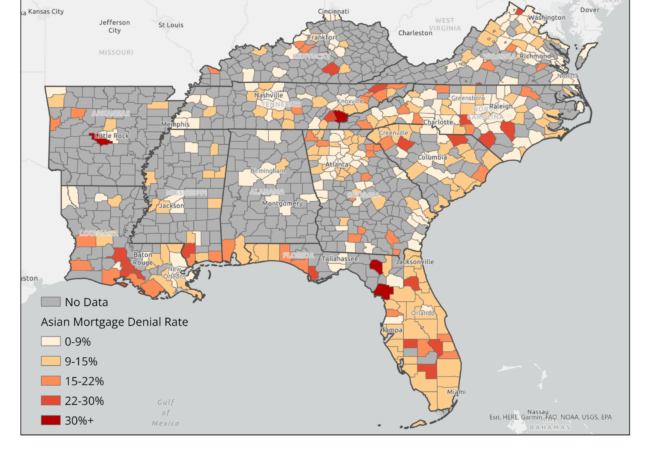

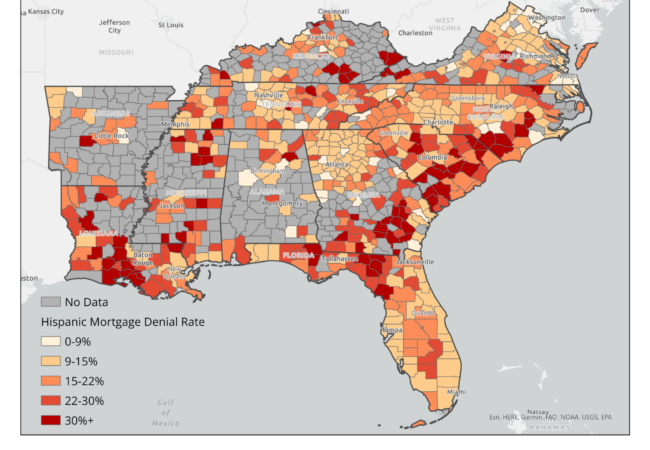

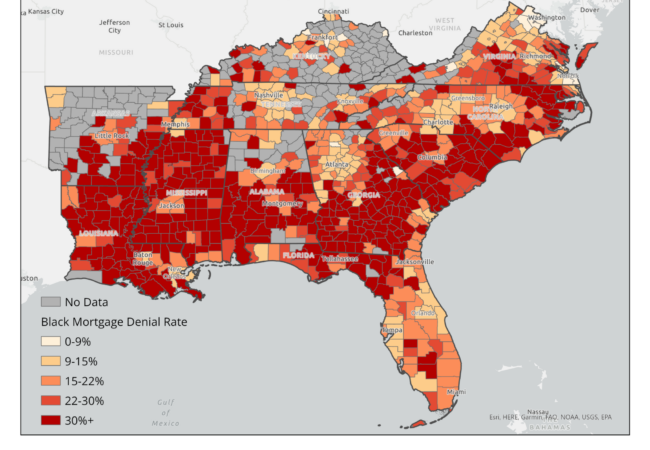

Redlining and other forms of housing segregation officially ended in 1968 with the Fair Housing Act, but access to lending still differs depending on a person’s race. People of color are still more likely to be denied access to mortgage lending than white people. Homeownership is the most common pathway to building generational wealth in the United States and limiting access to capital for buying a home not only prevents people from healthy, safe, and affordable housing and inhibits social mobility.

This month’s map tracks disparities in mortgage lending throughout the Southeast using data collected from federally- backed lenders as part of the Home Mortgage Disclosure Act (HMDA). It shows the mortgage denial rate by race among counties in the Southeast between 2018 and 2022. As housing costs and high- interest rates raised monthly mortgage payments, lenders denied around 12 percent of home purchase mortgage applications in the Southeast. However, the applicants are not denied evenly. Between 2018 and 2022, about 10 percent of non-Hispanic white applicants, 8 percent of Asian applicants, 14 percent of Hispanic applicants, and 21 percent of Black applicants in the Southeast were denied mortgage loans.

In 2022, the most common reason for mortgage application denials was insufficient income. Income also varies by race. The median non-Hispanic, white household income in 2022 was $81,000; Asian household income was $109,000, Hispanic household income was $63,000, and Black household income was $53,000. Inequities in income, lending, and the ability to build wealth impact a household’s ability to access safe and healthy housing. A lack of mortgage capital also makes it difficult for people to access the benefits energy efficiency, whether through housing choice or home retrofits. Stay tuned for a forthcoming map on lending for home improvements, which will shed light on the ability of households to achieve energy efficiency savings through home improvement capital.