Category: COVID

How to navigate growing pains in the rapidly evolving electric vehicle value chain

Rekha Menon-Varma, Vertaeon LLC and Justin Brightharp, Southeast Energy Efficiency Alliance (SEEA)

The COVID-19 pandemic has exposed far-reaching supply chain vulnerabilities on items ranging from food and medical supplies to semiconductor chips. The automotive industry, in particular, has weathered severe production impacts due to the chip shortage. On the growth side, billions of dollars of investment is expected along the electric vehicle (EV) supply chain from automotive manufacturers, battery manufacturers, battery recycling facilities, and other stakeholders, including major investments in the Southeastern United States (U.S.). These investments are expected to create thousands of jobs and generate billions in economic value.

The joint webinar led by Vertaeon LLC and SEEA on March 9, examines potential risks in the EV value chain. In this blog, we take a brief look at current and evolving risks. The key takeaway is that manual risk assessments will not be sufficient in this fast-paced, global, EV market evolution. ‘The automotive industry will need to continuously track and analyze risks as they emerge and leverage advanced analytics and artificial intelligence (AI) to do so to enable EV market growth.

As the EV supply chain continues to develop, grow, and mature, it’s crucial for all stakeholders, from manufacturers to the end user, to manage expectations as it relates to vehicle and battery performance, infrastructure access, maintenance, and technology advancements. To meet these aggressive adoption goals, many automotive manufacturers are vertically integrating battery production and vehicle assembly either within their networks or through partnerships. The Biden administration has made it a priority to foster the growth of the electric transportation supply chain to enhance national security and mitigate risks. Diverse stakeholders such as investor-owned utilities, municipal utilities, and electric cooperatives will need to coordinate during this process. Additionally, this creates opportunities to further develop the value chain through identifying risks, offering solutions to mitigate those risks, and bridging gaps among partners to achieve higher resiliency.

Emerging challenges – Vertaeon Perspectives

By December 2021, several countries and automotive market leaders have pledged a move towards electric vehicles to curb greenhouse gas emissions (GHG) and decarbonize the transportation sector. Automakers in the U.S., China, Japan, and European Union (E.U.) are reportedly targeting 40-60% of new vehicle sales to be EVs by 2030-2035. While this is excellent news, both on the technology front and for addressing climate change, aggressive growth in EVs will mean overhauling production, developing new skills, and building new partnerships. Even if those requirements are met, limited raw material availability and constraints in the battery supply chain can severely hamper growth plans.

“One thing is clear – manual risk assessments will not be sufficient in this fast-paced, global, EV market evolution”

Vertaeon commented

There are six major risks to consider as the EV value chain evolves:

- Financial & Legal Risks: The revenue and profit impacts of 2021 present big challenges for the automotive industry, caused mainly by supply shortages, logistics, and the pandemic, while calling for major investments in the EV space. A company’s financial stress is a key risk indicator which provides insight for determining winners and potential for bankruptcies. Legal disputes such as the one between LG Chem and SK Innovation could impact battery and other key technology delivery. Legal events and disputes can severely curtail supply and impact local jobs.

- Player Concentration: The current EV value chain has fully integrated players with captive supply and large players have been integrating upward via partnerships with battery producers. The main battery producers are in Asia, in China, and South Korea. This points to the need for strategic planning by the U.S. and E.U., to establish their own supply and be resilient.

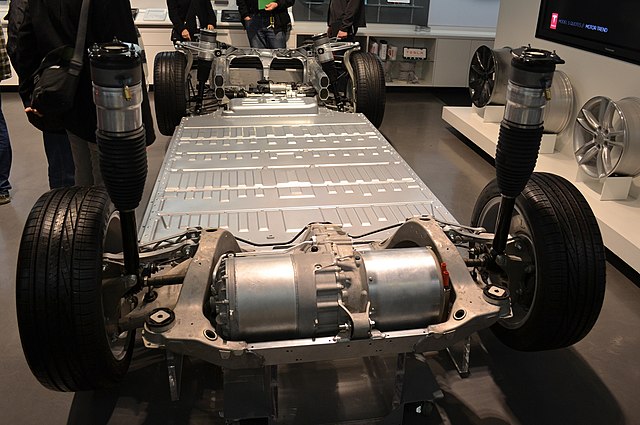

- Raw material and Battery-related risks: Lithium and cobalt prices surged in 2021, along with semiconductor price increases. Raw material sources are concentrated in Africa, South America, and Australia while most battery production is in China and South Korea. It is key to assess and track critical minerals sourcing locations and pricing in the supply chain.

- Geopolitical Risks: The U.S., E.U., and China account for 90% of the EV market and growth projections. China is estimated to make 73% of the world’s lithium-ion batteries. Ongoing U.S.-China discussions can potentially impact battery supply, intellectual property rights, and trade agendas, with outcomes in location strategies, and local partner developments.

- Environmental, Social, and Governance (ESG) risks: A slew of social and governance risks surround the EV supply chain including conflict minerals from the Democratic Republic of the Congo, the toxicity of cobalt, corruption indices of source countries, and labor issues to name a few. It is critical to map the supply chain and continuously monitor not only from a company’s sustainability perspective, but more importantly from a regulatory perspective.

- Innovation risks: Product and process innovation will dictate pricing/kWh, overall vehicle pricing and consumer adoption. Process innovation that utilizes alternate raw materials or critical components will eliminate some of the above risks. However, innovation can take years to come to fruition and require large investments, with a steep learning curve.

These risks are also opportunities for applying advanced analytics/AI and utilizing insights for risk mitigation and competitive advantage. It has become imperative to assess and track risks and volatility continuously, and to leverage technology and subject matter expertise.

Federal Funding Opportunities for EV Supply Chain – SEEA Notes

The Biden administration has prioritized investment in electric transportation projects and the electric vehicle supply chain. Federal funding programs are an opportunity for stakeholders interested in transitioning their fleet to apply for funds. In November 2021, the Infrastructure Investment and Jobs Act was signed into law and includes provisions for investments into the supply chain. Atlas Public Policy’s EV Hub provides a breakdown of the legislation. The implementation and timeline for distributing funds is still being developed. Additionally, you can watch the recording of SEEA webinar, Advancing Electric Transportation: How to Leverage Federal Support in the Southeast, which provides a federal overview of investments into electric transportation. SEEA encourages stakeholders to stay informed as funding opportunities announcements are released by respective federal agencies.

Join us on March 9, 10 a.m. ET for the companion webinar on EV value chain risks with Vertaeon and SEEA!

Authors: Rekha Menon-Varma is managing partner at Vertaeon LLC, an advanced data analytics firm focusing on Enterprise and Supply Chain Risk and ESG analytics (SaaS tools) and insights. Vertaeon offers scalable and customizable SaaS web platforms, with easy implementation and actionable insights for decision-making. Justin Brightharp is SEEA’s energy efficient transportation manager. He supports SEEA’s transportation initiatives through policy, research, and stakeholder engagement.

For media inquiries to Vertaeon contact Brandon McKay Crooks

For media inquiries to SEEA contact Sarah Burgher

Disclaimer: The content in this article is intended for informational purposes only. Vertaeon provides no endorsement and makes no representations as to accuracy, completeness, or validity of any information or content on, distributed through or downloaded, or accessed for this article. All rights and credit go to original content owners from various sources. No copyright infringement is intended. Vertaeon will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All information is provided on an as-is basis without any obligation to make improvements or to correct errors or omissions. Vertaeon makes no guarantees or promises regarding the sources and does not necessarily endorse or approve of their content. You may contact Vertaeon at www.vertaeon.com with any questions.

Our top blog posts of 2021

In 2021, the covid-19 pandemic continued to influence our desire to improve the safety and efficiency of our indoor spaces and we saw an increased public and private investment in energy-efficient technology, manufacturing, and policy. SEEA welcomed a new president, and we expanded and deepened our commitment to equity within our industry. In this notable year, these are the blog posts that you read, shared, and liked the most.

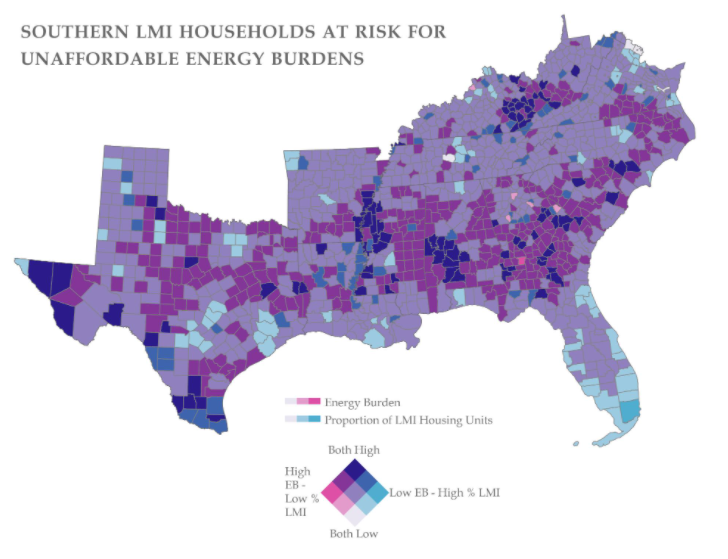

1. What is energy security versus energy burden?

Originally published March 15, 2021

Last month, SEEA released our report, Energy Insecurity Fundamentals for the South. We believe using common metrics is essential to creating robust and prescriptive policies that address the multiple dimensions of energy insecurity. […]

2. Going beyond recovery with the American Jobs Plan

Originally published April 22, 2021

For patients recovering from a major illness or trauma, doctors stress the importance of improving social wellness as a part of recovery. They prescribe getting back on your feet as the first step, but note that staying healthy requires a long-term investment in one’s physical, mental, and social health. […]

3. Energy efficiency for all – the opportunity ahead

Originally published May 6, 2021

While I officially started working at SEEA on April 26, I have had the pleasure of working with SEEA staff and board members for more than ten years. The team’s dedication to realizing a more energy efficient Southeast that benefits all people has long inspired my curiosity […]

4. How American Efficient is realizing a more diverse energy industry

Originally published November 10, 2021

The American Efficient DEI Action Team

Over the last year, a team at American Efficient developed a Diversity, Equity, and Inclusion (DEI) action plan to put some of our company’s values into practice. As a group of mostly white people in a mostly white company—and industry—we regard this as a privilege, in all senses of the word. […]

4. The Infrastructure Investment and Jobs Act will transform the Southeast

Originally published November 12, 2021

On Friday, November 5, the U.S. House of Representatives passed the Infrastructure Investment and Jobs Act. The bill passed the Senate in a bipartisan vote in August and President Biden is expected to sign the bill on Monday, November 15. The $1.2 trillion package is a historic investment in infrastructure that advances energy efficiency, resiliency, and electric transportation. Combined with the President’s Build Back Framework, it will average 1.5 million additional jobs every year for the next 10 years. […]

COVID-19 Resources: Delivering customer support in a new world

Since our last post, new unemployment numbers for the energy efficiency sector have not been released. The most recent unemployment and disconnection information can be found in our previous post. We continue to monitor those reports and will update this series with new information as we receive it.

In the eighteen months since we first learned about COVID-19, we have realized that our lives would not be returning to normal as quickly as we had hoped, and there could be some new aspects of daily life that remain long after the coronavirus subsides. Many of us are still working at home, schools weigh continuing precautions, and while improved, unemployment remains high. We have been listening to how our industry and our members’ work has changed since spring 2020 and how it continues to adapt while we learn to live through a pandemic.

When service providers could not enter homes and provide services like home energy assessments and weatherization upgrades, organizations looked for other ways to keep the workforce engaged and provide uninterrupted services to customers. The pandemic also exposed the fault lines in the systems that deliver energy to our homes, schools, and businesses. Our community discovered an opportunity to ensure that all people could live and work in comfortable buildings, expand electric mobility, and create more prosperity across the Southeast.

In October 2020, we surveyed our utility partners and found that many energy efficiency programs had fully resumed, with adaptations or brand new programs to reach home-bound customers. In June, at the National Energy & Utility Affordability Coalition (NEUAC) annual conference, director of energy efficiency policy, Cyrus Bhedwar spoke on how to include more equity in program design, and we learned how program delivery is changing to reach more people at home. Some of the ways utilities are innovating around service barriers include:

- Phone-based walk-throughs with customers

- App-based surveys

- Virtual training for contractors

- Online applications and e-signatures

- Extended crisis benefits to customers affected by COVID

Technicians, service providers, and utilities have found these adaptations not only maintained business during a pandemic, but also improved many facets of program implementation like scheduling, cost, customer engagement, and delivery time. However, innovation does not come without some hurdles. Poor cell phone reception, battery life, and customer access to technology are common challenges. Implementers encountered issues such as trying to explain how technical instruments worked to nontechnical customers. Despite these concerns, companies are keeping many of the innovative approaches to providing remote or virtual energy efficiency services.

As the region, nation, and world grapples with how to tackle the coronavirus, the energy efficiency sector continues to take steps to improve the health, comfort, and resilience of our communities. We continue to seek out and monitor the ways in which our industry continues to adapt to a new way of working and living in a pandemic.

Additional Resources:

Energy Efficiency Jobs in America

E4TheFuture

Sustainable Energy in America 2021 Factbook

BCSE

COVID-19 Resources

Our new COVID-19 Resources allows for more relevant and more frequent updates. You can access the original, archived resource page at any time.

We welcome your feedback and suggestions. Contact us anytime at [email protected].

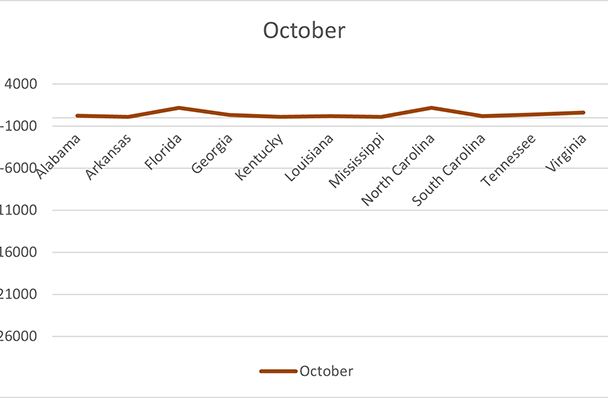

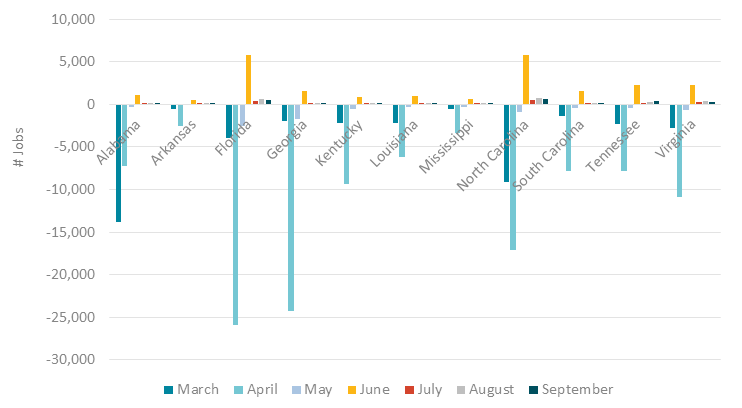

Highlights

- The U.S. lost over 429,000 clean energy jobs from March to December, finishing 2020 with the fewest number of workers in the industry since 2015 It also marked the first year clean energy saw a decline in jobs over the previous year.

- Nationally, job losses in the clean energy and energy efficiency sectors increased 12% since the pre-pandemic era.

- 16,900 jobs were added nationally in December.

- Clean vehicles experienced ongoing job loss of 31,468 and recovered about 400 jobs.

- “Black and Hispanic workers continue to suffer from disproportionately high levels of unemployment overall, and Hispanic workers suffered increased unemployment rates in December. Women – particularly women of color – lost jobs in December overall while men gained jobs.”

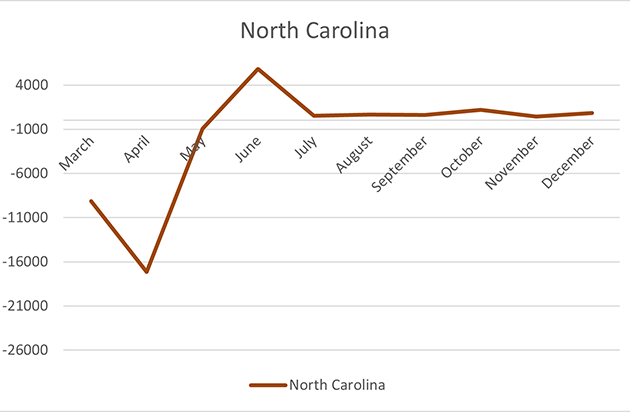

- In December, the states with the largest gains, Texas, New York, North Carolina, and Florida secured more than 800 clean energy jobs

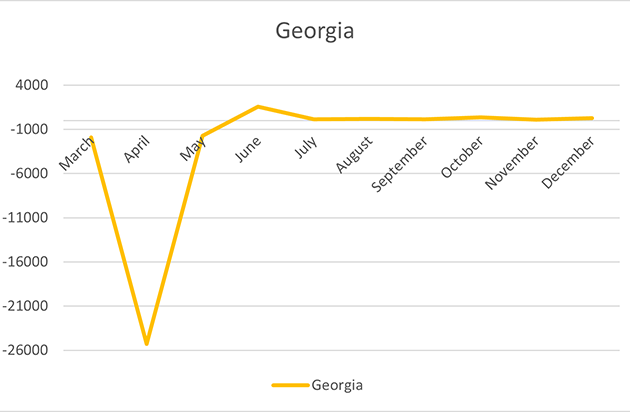

- “Over 40 states continue to suffer double digit job losses in clean energy with four states facing 20 percent or greater unemployment and one state, Georgia, facing 30 percent unemployment in the sector.”

- “The counties that suffered hardest as a percent of their workforce are Fulton County, GA; DeKalb County, GA; and Kern County, CA.”

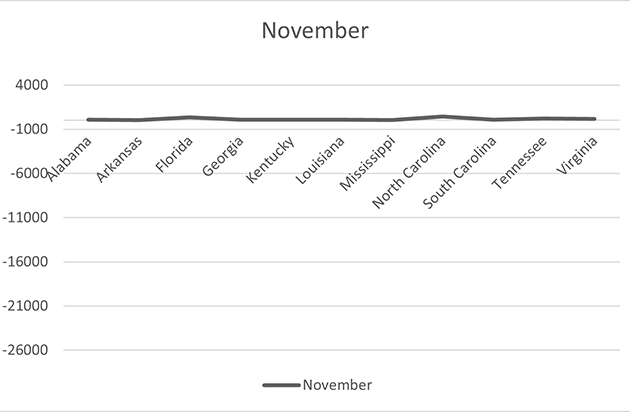

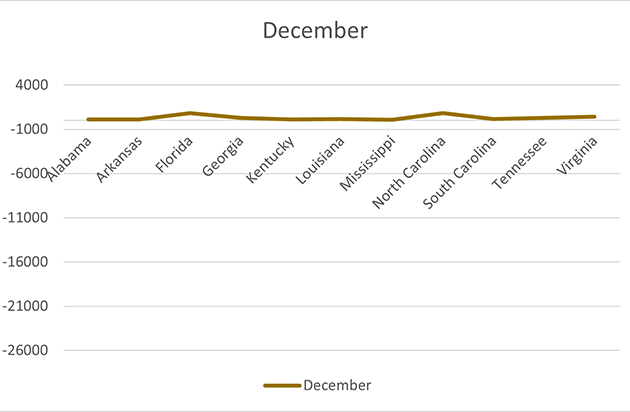

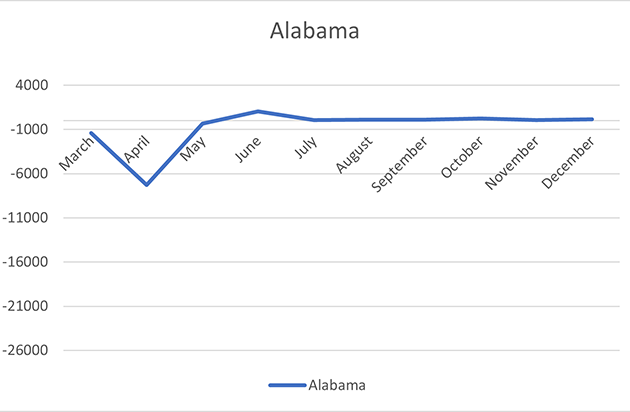

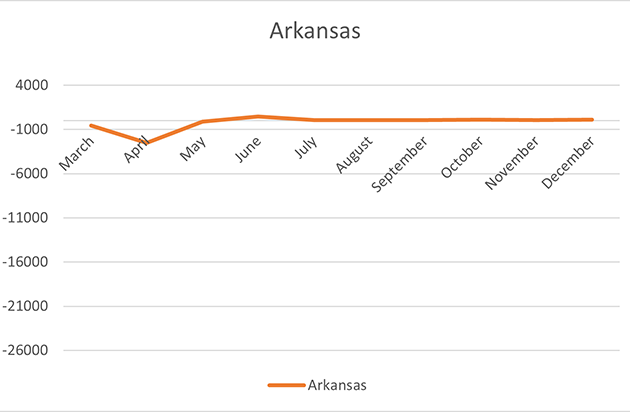

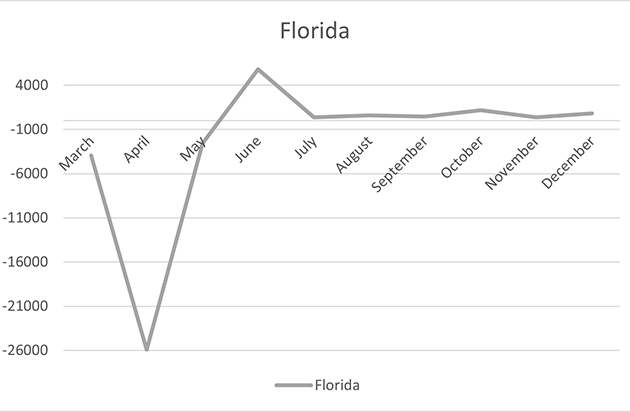

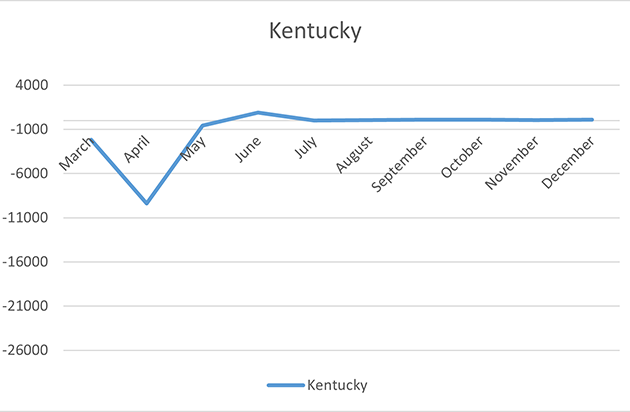

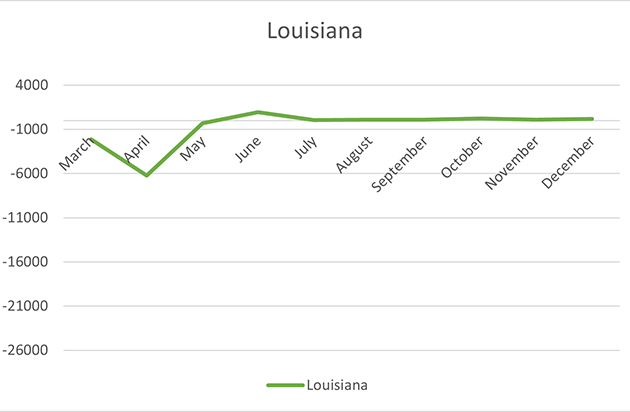

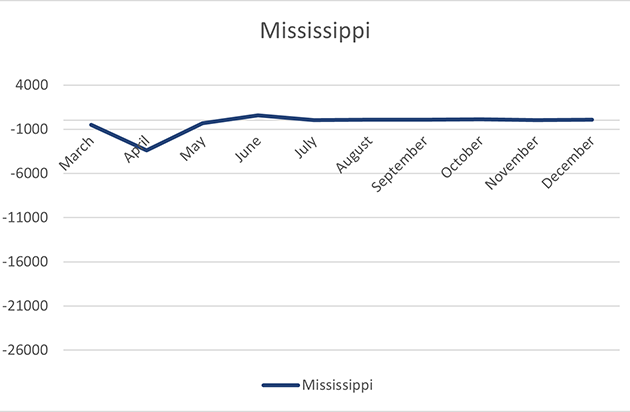

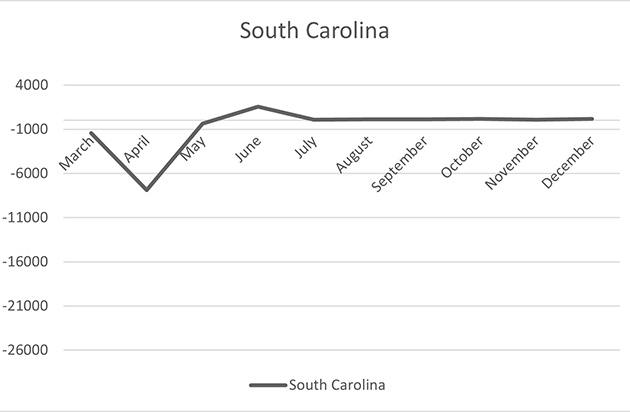

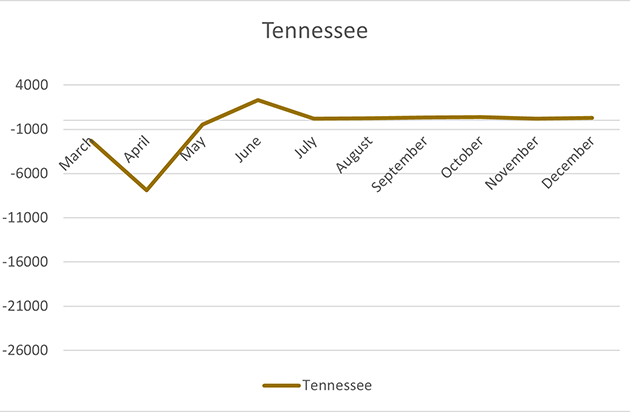

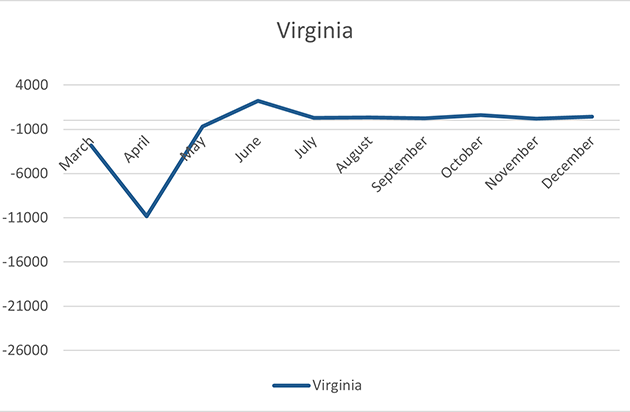

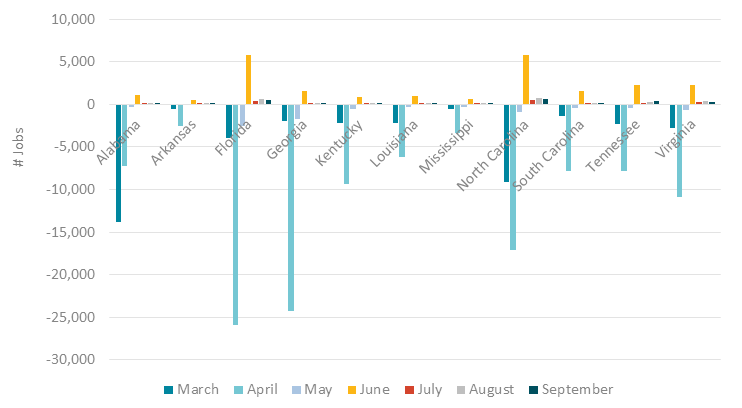

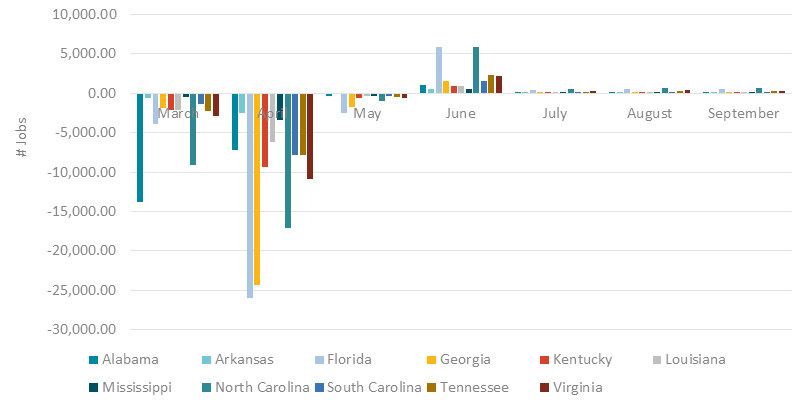

Workforce Losses by Month (March – December 2020)

Workforce Losses by State (March – December 2020)

Related News

- EIA estimates in its Annual Energy Outlook 2021, that it will take 10 years for energy consumption from all energy sources to return to pre-pandemic levels.

- Bloomberg New Energy Finance and the Business Council for Sustainable Energy reports in the annual Sustainable Energy in America Factbook that although energy use dropped 3.8% overall, residential electricity use increased.

Highlights

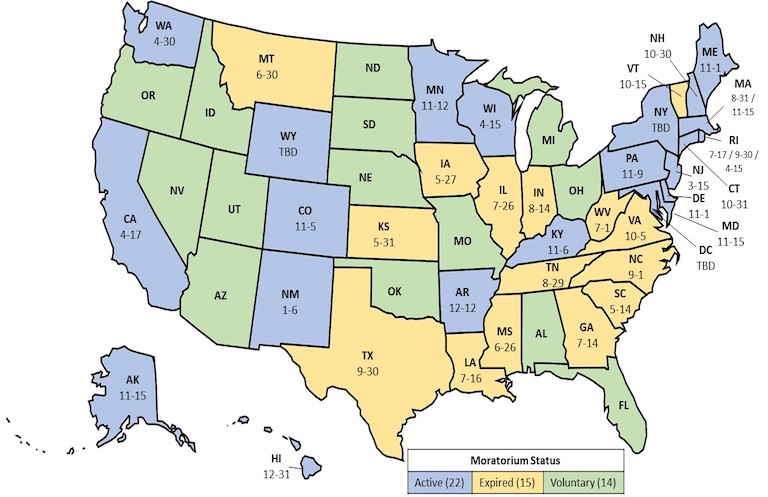

- All eleven of the states in SEEA’s territory have resumed utility disconnections. Some commissions have restored winter disconnection moratoria to alleviate mounting customer arrearages.

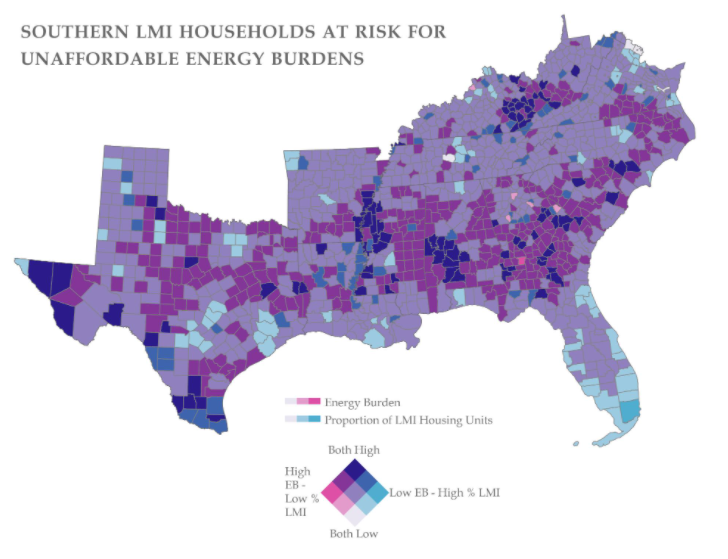

- Customer arrearages or energy debt adds to a household’s energy insecurity. Energy insecurity is a key metric for understanding the inequitable distribution of the benefits and burdens of the energy sector to residents of the Southeast. Learn more about energy insecurity in our recent blog post, report, and storymap.

- NARUC has a new tracker following state responses to utility disconnections.

- NEADA tracks dates for COVID19 disconnection moratoria along side annual winter disconnection moratoria.

Related News

COVID-19 Resources

This month, we moved our COVID-19 Resources to a new format to allow for more relevant and more frequent updates. You can access the original, archived resource page at any time.

We welcome your feedback and suggestions. Contact us anytime at [email protected].

October 2020

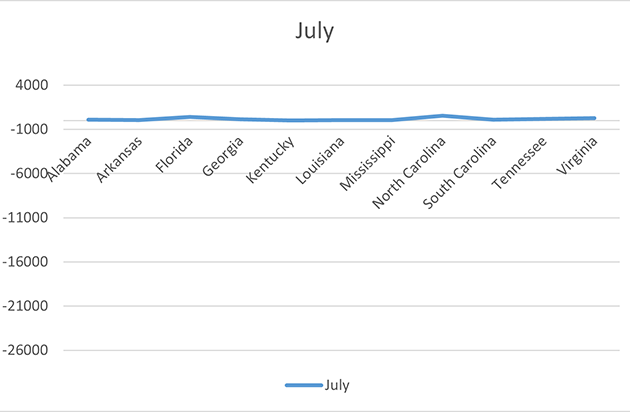

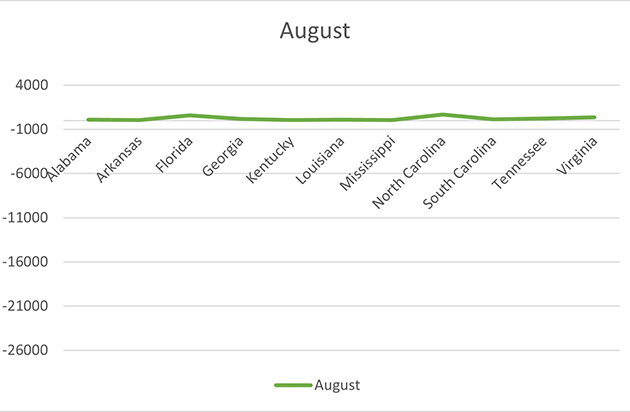

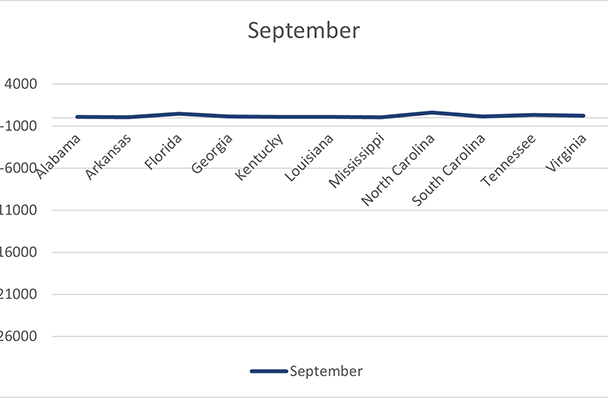

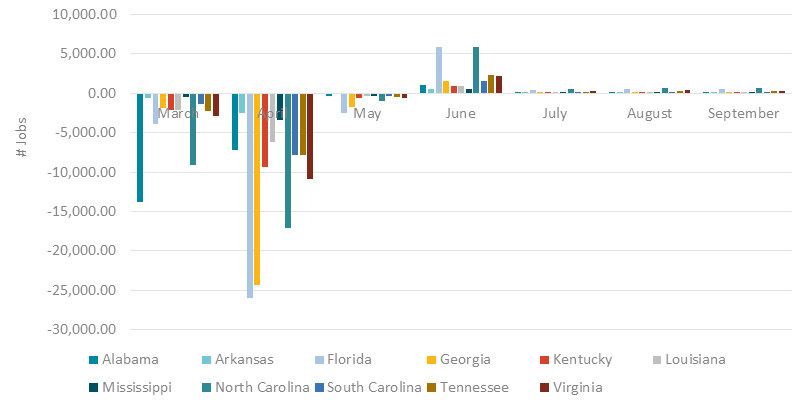

Southeast Job Losses and Gains, March – September 2020

Highlights

- The U.S. lost over 477,000 clean energy jobs from March to September.

- Nationally, job losses in the clean energy and energy efficiency sectors increased almost 14% since the pre-pandemic era.

- 12,500 jobs were added nationally in September.

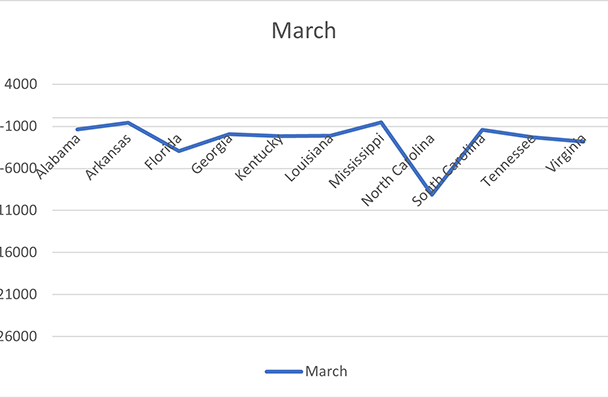

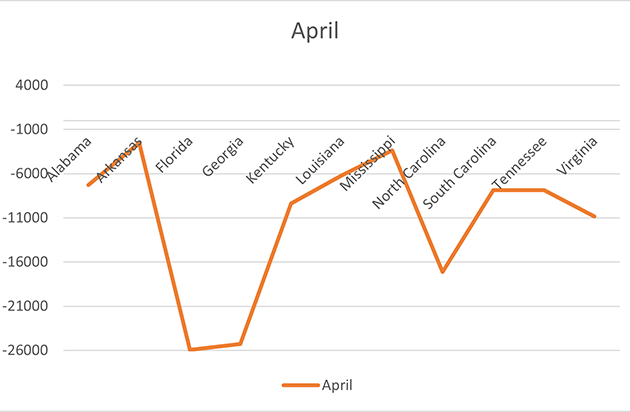

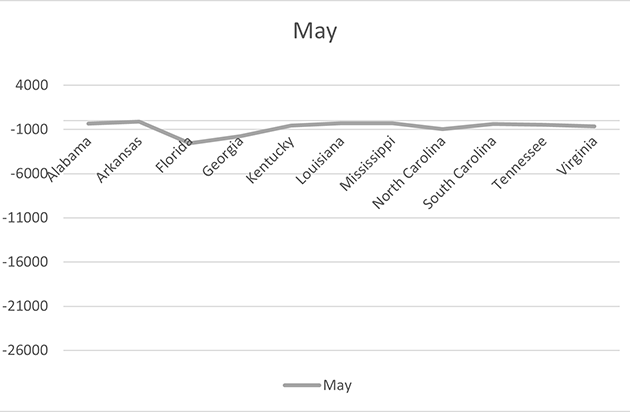

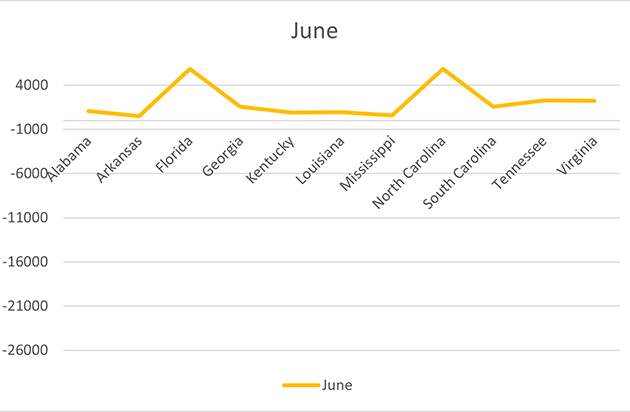

- Florida, Georgia, and North Carolina experienced the greatest losses in April; and Florida and North Carolina gained back the most jobs in June.

- Jobs were added monthly between March and September.

- June saw the highest job gains across the region.

- The Southeast states experienced small but steady job increases July through September.

Related News

- E4 The Future’s blog shares the individual, personal, and resilient stories of the energy efficiency workforce.

- Utility Dive takes a look at how utilities can support diverse business entities impacted by the COVID-19 crisis.

Highlights

- Since March, utility disconnections have paused and restarted. In the Southeast, moratoria remain in Kentucky.

- NARUC has a new map of disconnection moratoria and the status of payment plans.

- Regulators and utilities using several means to ease the strain on customers:

- Increasing energy efficiency funding

- Leveraging charitable contributions

- Redirecting surplus (lowering natural gas prices)

- Offering bill payment assistance and flexible payment plans

Related News

- Georgia Power Foundation invests $1 million to support state in COVID-19 recovery

- Knoxville Utility Board receives more than $4 million to help customers pay utility bills

- Huntsville Utilities COVID-19 relief fund supports charity groups and local customers

- Governor Cooper announces $175 million in assistance with rental, utility payments for North Carolinians

- NRECA supports bill to keep families connected to broadband amid pandemic

- 3 ways utilities can help low-income families impacted by COVID-19

Read more…

- See the archived COVID-19 resource page

- See all COVID-19 posts

Wacky Wednesday

Mandy Mahoney

Where are we? What is going on? Why is there a piece of bacon hitting a baseball?

Today my son’s kindergarten class is hosting a virtual Wacky Wednesday. He decided to wear his Macon Bacon t-shirt because a piece of bacon playing baseball is pretty wacky. The Macon Bacon is part of the Coastal Plain League, an amateur baseball league comprised of college baseball players from schools like Georgia College and Eastern Kentucky. Last August, in the slow heat of the Georgia Piedmont, our family went to a match-up between the Macon Bacon and the Savannah Bananas. There was no breeze blowing through historic Luther Williams Field. The ball field was built in 1929, and has seemingly stood still in time for the last 90 years.

The game was a highlight of our summer. On a Friday afternoon, we drove down to my hometown and met my mom. We dined on Macon’s famous Nu-Way Wieners. At the ball field, my son excitedly sought out Kevin, the team’s half person, half bacon mascot, to take a picture with him. The baseball wasn’t very good, and I don’t remember who won, but that wasn’t the point.

That time seems so far away on this Wacky Wednesday. Now every day feels like we’re living Wacky Wednesday. Last week, Anne and I heard from one of our partners, “If you would have told me a month ago that I would be talking about where to get toilet paper on a work call I would have thought you were crazy.” We are all pretty shocked that our lives have shifted so dramatically, from supply scarcity, to virtual everything, distance learning, grocery delivery, job losses, and grief.

It all feels pretty wacky.

What I loved so much about the Macon Bacon game was being in community with people I loved and people I didn’t even know, the connection to my hometown, and introducing my son to a part of my history. We all still want those things today. Our brains are struggling to make sense of the rapid changes happening all around us. We struggle through the bewilderment of how to maintain and find that authentic, deep connection to family, friends, and colleagues during the pandemic.

The team at SEEA and I have consciously slowed down our work and our pace of activity. We believe now is a time to reach out to our partners and observe what the real needs are in this new era before we move into action. Yesterday, Cyrus and I were on a video call with another close partner and he started out by saying, “Well I am not sure why we are talking today.” My response was that we care about him and just wanted to see how he was doing. I could instantly see a sense of relief come over him. He appreciated that we simply wanted to know how he and his family are doing. We got around to talking about work later in the call. When we approach opportunities for connection with vulnerability and curiosity, we experience deeper, and more meaningful relationships.

Our conversations with partners and stakeholders over the last 10 days have given us some glimpses of the needs and strategies. We find a consistent concern about the burden of energy bills for the waves of workers laid off from the restaurant, retail, and many other impacted industries. We also hear a theme that we both want to respect the real suffering of this time while also not missing the opportunity to build back better.

We want to connect with you. We want to hear your thoughts, reflections, concerns, and ideas. We are better and stronger together.